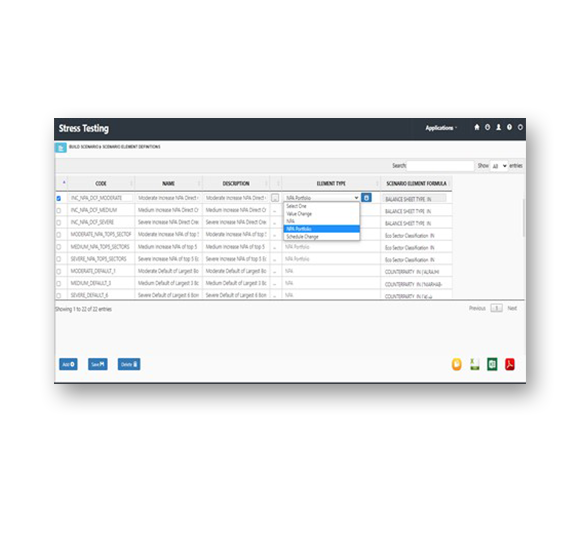

This module enables financial institution to develop a robust, auditable and transparent stress testing program to meet regulatory expectations, test risk appetite outcome and improve business decisions making.

You can construct and implement comprehensive organization-wide stress testing through balance sheet and risk simulation of all Basel II - Pillar I / Pillar II risks, and assessing simultaneous impact on measures such as capital, income & liquidity. Allows configuration and analysis covering multiple scenarios and sensitivities for existing portfolio including what if analysis.

© Copyright Avati Consulting Solutions 2022. All Rights Reserved.

Privacy Policy