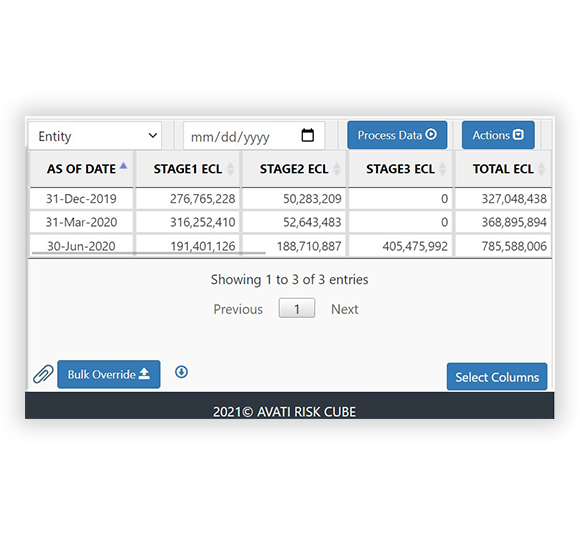

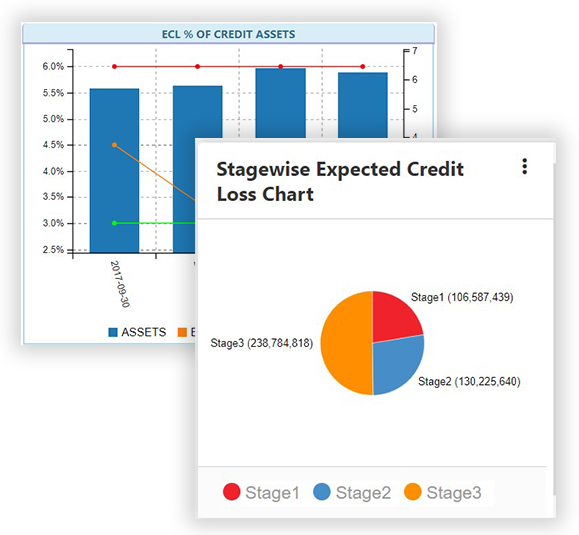

A comprehensive Solution to implement IFRS 9 guidelines and business decision making with complete automation. Covers products, exposures, cash flow analysis, classification, customer staging, business processes like collateral, IIS allocation, limits, IFRS 9 segmentation and configuration of multiple rule-based IFRS 9 models for ECL calculation and reporting. Comprehensive data management, DQ and business validation, Advanced reporting studio, comprehensive regulatory / internal reporting. Covers calculation and reporting of provisions based on IAS 39 (Old provision guidelines).

© Copyright Avati Consulting Solutions 2022. All Rights Reserved.

Privacy Policy