Case Study: Implementation of Capital Assessment Platform

Client

Global Wholesale Banking Group based in the Middle East having exposures across major global economic centers.

Broad Scope

As part of the Strategic Risk Transformation Program, the group wanted to implement Basel II regulatory guidelines for capital reporting. The client wanted to implement monthly reporting cycles for regulatory reporting and internal MIS.

Our Approach & Solution

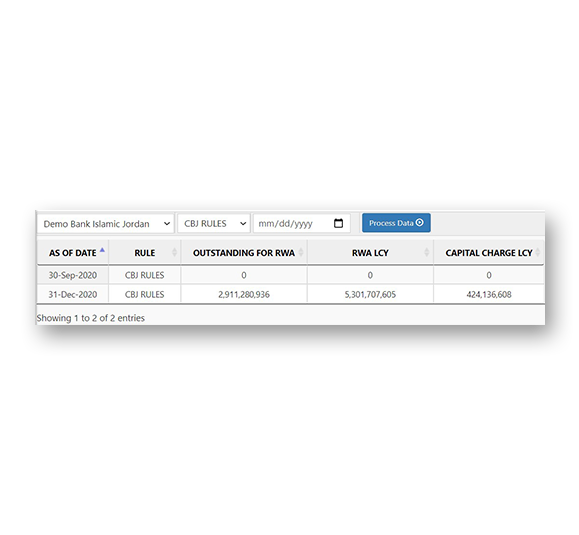

To achieve Client objectives we have implemented Capital Assessment Platform (CAP) product module as part of RiskCube Implementation.

During start of the initiative, we helped the client prepare a comprehensive Basel II implementation Roadmap wherein we mapped required activities, data and business processes to core banking systems. This led to significant modification of certain existing business processes and implementation of new processes within the Bank in order to get the required data. We were able to achieve desired integration with core banking system without need for any manual intervention or process.

Our flexible product platform ensured all regulatory rules were configured and parametrized through easy-to-navigate front end screens. We were able to achieve 100% automation for generating more than 60 monthly reports for capital adequacy. The Product was implemented with further capability to generated user defined reports through capital reporting cube with deal level drill down capability.

A thorough UAT was successfully conducted by Bank’s internal Risk Management department for consistency and accuracy of results. 100% reconciliation to General ledger and Trial Balance was achieved during this implementation post which the project was successfully signed off for production movement and Go-Live transition.

Business benefits

Significant business benefits were achieved post project implementation. Apart from implementing global benchmark best practices, the Bank was successful in complying with latest regulatory guidelines for capital adequacy in line with leading institutions regionally and globally. The Bank has been able to calculate capital requirements based on latest regulatory guidelines for the 1st time and has greater insights into the consumption patter of capital based on customers, products, businesses and efficiency.

Additionally, RiskCube platform has helped the client successfully create a strong foundation for Risk Data Mart which has become the repository of critical risk data for the group for conduct of future risk analytics.